The Best Indices Brokers Guide

What are indices and why should you trade them? Indices are trading measurement that show how the performance of a certain group of stocks changes over time. Stock indices are made up of many stocks and are calculated based on the prices of those stocks or the market value of the companies that issued them. The mix of stocks used to calculate the index shows what kind of accurate information can be gotten from looking at this index.

Using indices in trading lets you not only spread out your investments, but also gather and analyze information quickly about the global economy or a specific sector.

Best 3 Online Brokers for 2024

Indices are very important not only because they provide information, but also because of their investment purposes. In this article, we’ll explain what indices are and how to use them when investing in the stock market.

Top Broker Choice for Forex, Stocks and Indices

What is a stock index?

First, what exactly is an index? A stock index is an indicator that measures a small part of the stock market. In other words, it’s a way to track the performance of a group of assets in a standard way. Since the index can represent a specific stock market, sector, geographic segment, or other part of the market. These benchmarks are made in a clear way, and the methods used to make them are spelled out. There are also indices for the bond market, commodities, and interest rates, but we will only talk about stock indices in this article.

Construction can be very different because the indices are based on different methods (e.g. market capitalization weighting, free float-adjusted market capitalization weighting or equal weighting). But the main idea is still the same: a stock index is a group of stocks that follows the price changes of the stocks in the group.

Live Stock Indices Markets

The world’s most important indices

Now that we’ve talked about how important stock indices are and what they mean for the world markets, it’s time to name some of the most important ones. Investors pay the most attention to benchmarks from developed economies, like the New York Stock Exchange (NYSE), Nasdaq, London Stock Exchange (LSE), Euronext, or Shanghai Stock Exchange (SSE). XTB has a wide range of CFDs on indices, and the names of these contracts are simple enough that investors should already know them. See the most popular indices below:

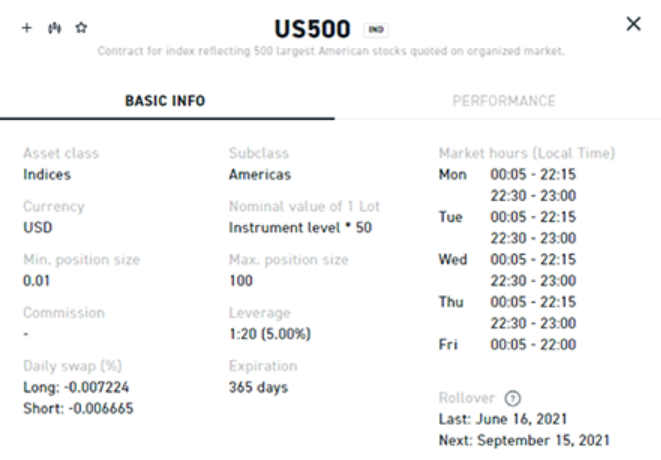

- US500: a contract for an index of the 500 biggest companies in the US. It is often used as a measure of how the stock market is doing as a whole. The Index is often used to measure the performance of active portfolios.

- US100: a contract for an index of the 100 largest non-financial companies listed on NASDAQ.

- US30: a contract on an index made up of 30 large U.S. companies. These companies are listed on the NYSE or NASDAQ.

- UK100: a contract for an index of the 100 largest companies on the London Stock Exchange by market capitalization.

- AUS200: a contract for an index of the 200 biggest publicly traded companies in Australia.

- EU50: a contract for an index of the 50 biggest and most liquid stocks in the Eurozone. It is mostly made up of French and German companies.

- JAP225: a contract for an index of 225 large Japanese companies that are listed on the stock market.

The importance of indices

Indices are very important to the financial markets around the world. First, they help investors figure out how the stock market is doing every day, week, month, etc. This lets people in the market figure out how the market is feeling and compare different stock markets. Indexes are also used as benchmarks for stocks because actively managed funds use them to compare how well their funds are doing.

“Index trading” and “index investing” are two terms that are often used to talk about stock indices. In recent years, both ideas have become more popular. Index funds and exchange-traded funds are becoming more popular. Many people like them because they are low-cost and offer diversification benefits. How to Diversify Your Portfolio: How to Diversify Your Trading Portfolio? On the other hand, index trading can refer to contracts for difference (CFDs), which investors use for both speculation and risk management.

Why trade indices

When you trade indices, you can get exposure to a whole economy or sector with just one position. Instead of having to open several trades with different companies.

Traders can just open long positions to profit from prices going up or short positions to profit from prices going down. Leverage can sometimes make gains or losses bigger. Trading indexes can be part of different strategies, such as the belief that small caps will do better than blue chips (in which case traders should buy long positions in a small cap index) or the belief that a certain exchange, for example B, will collapse because of geopolitical reasons (in which case traders should sell short positions in the relevant country’s index).

Final word

In summary, trading indices can be a very useful tool that investors and traders should definitely know about. Even though trading indices can be risky because of how leverage works, it can also be a great way to protect a portfolio of trades and reduce risk. So, knowing how to trade indices should be seen as a must-have skill for any serious investor.

Indices available in the markets

- Synthetic indices

- Futures

- Stocks

- Commodities

- Forex